Investors are being provided with some meaningful signals for optimism as the sun brightens and the weather warms with the summer about to begin. This does not mean, however, that we should be ready for blue skies from now on, as the blue days that made markets challenging at times over the last eighteen months may not yet be gone.

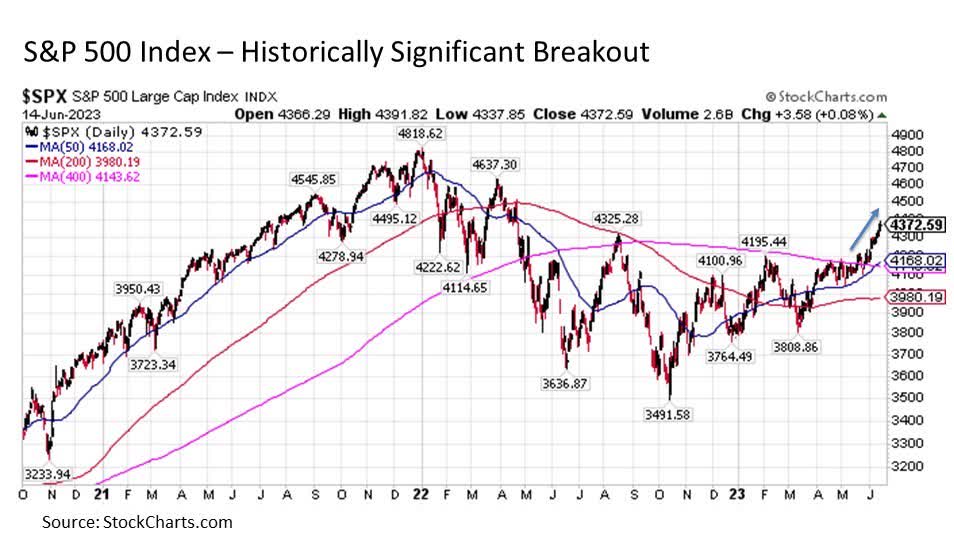

Key breakout. The chart below says it all.

After falling into a bear market and being stranded below its 400-day moving average for more than a year, the S&P 500 Index has broken out decisively above this key resistance level.

Why is this breakout so significant? Over the last 100 years, the U.S. stock market as measured by the Dow Jones Industrial Average prior to 1950 and the S&P 500 since has descended below its 400-day moving average for a prolonged period on 18 different occasions. And in every past instance, when the U.S. stock market moved decisively back above its 400-day moving average, it signaled the eventual end of any bear market. In addition, U.S. stocks eventually proceeded to new all-time highs in all but two instances, both of which took place during the Great Depression and World War II period from 1937-38 and 1940-42.

Thus, the fact that the S&P 500 has moved decisively above its 400-day moving average is a significant development that may be signaling further upside in the days, weeks, and months ahead if historical precedent is any guide.

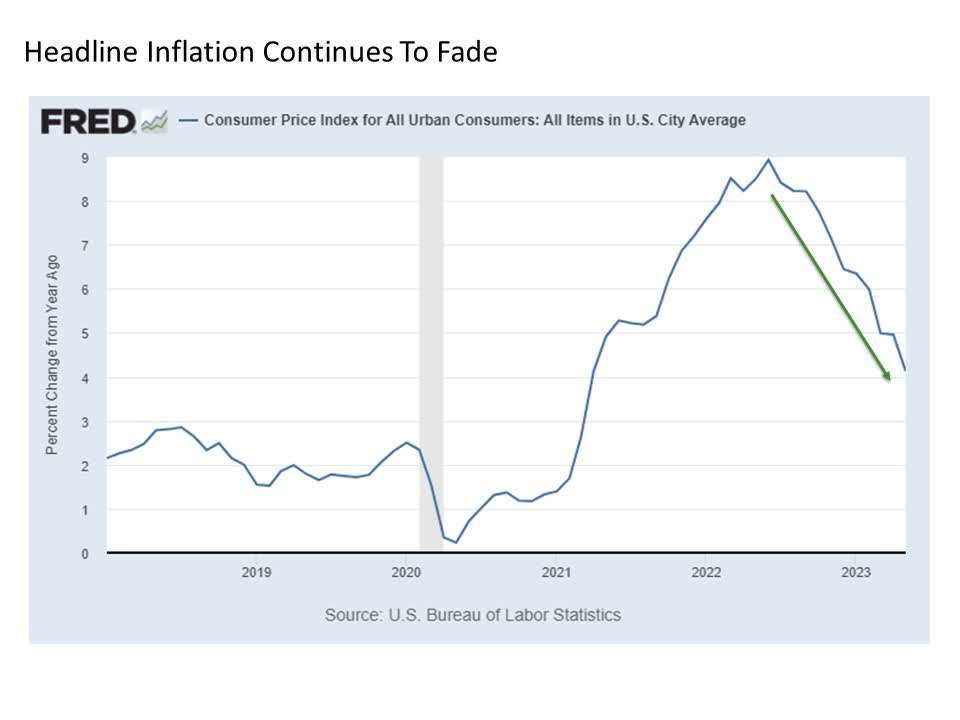

Cooling jets. Another trend is also providing clear skies for U.S. stocks. After a prolonged stretch of rising pricing pressures through the middle of last year, the inflation rate as measured by the Consumer Price Index continues to cool. The latest inflation reading for the month of May dropped by more than 80 bps from 4.9% to 4.1%, which is a meaningful move in the right direction for markets at least from a headline perspective.

Of course, it’s not just about where inflation is today, but also where it is expected to go in the future. And the news here is also promising, as the 5-Year Breakeven Inflation Rate, which implies what market participants expect inflation to be in the next five years, continues to descend lower toward 2%. This is the same 2% reading that was in place in the late 2010s prior to the onset of COVID.

These signals are meaningfully positive in suggesting blue skies ahead for U.S. stocks.

Blue days may not yet be gone. If only investing were that easy. While the building optimism and relative strength of the U.S. stock market along with the fading inflation rate is certainly positive, it does not at all mean that capital markets are not without meaningful risks that may bring sudden and unexpected storm clouds at any point in time in the months ahead.

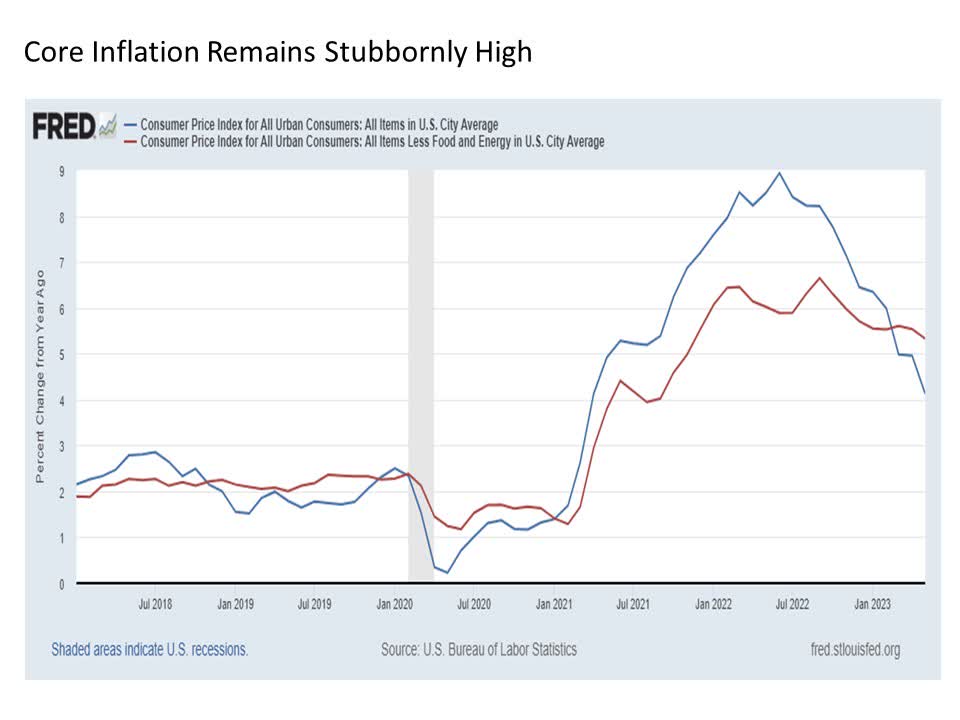

First, while headline inflation is indeed coming down quickly, the same cannot be said for the core inflation rate. Exclude the more volatile food and energy components, and the core inflation rate is hardly budging, as the latest year-over-year reading at 5.3% is still troublingly high and not that far below the 5.7% to 6.6% range where the core rate hovered throughout 2022. Thus, while the inflation situation may be improving, a lot more work still needs to be done and the risk remains for inflation to start shifting back higher.

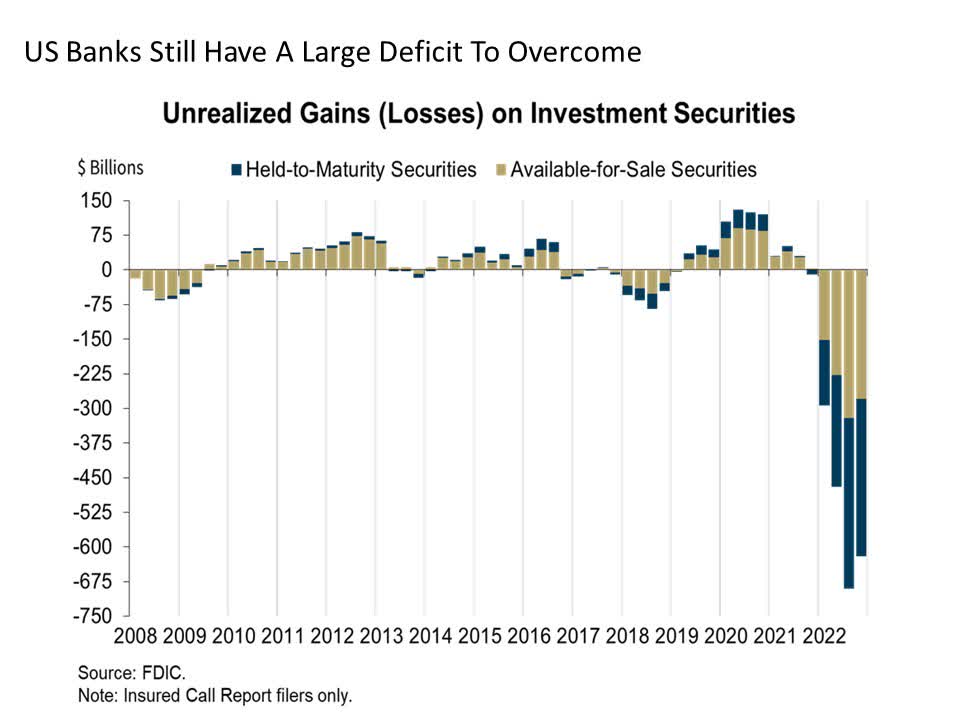

Another notable and related thundercloud lurks on the horizon. While all the clamor about U.S. banking stress has subsided for now, the underlying problem has not gone away. The following chart highlights the magnitude of the problem that many U.S. banks continue to confront today.

Relief could eventually start to come to U.S. banks if inflation continues to abate and long-term bond yields start to make their way back lower in a meaningful and sustainable way. But with asset markets like stocks accelerating anew and core inflation proving stubbornly high, such relief in meaningfully lower bond yields may not be coming anytime soon. As a result, we should not be surprised if renewed bouts of banking stress suddenly reappear on the investment skyline.

Bottom line. The recent breakout in U.S. stocks along with cooling inflation data are certainly most promising signs for better days ahead. But investors should not lose sight of the significant downside risks that continue to linger just over the horizon.

Disclosure: Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.