The U.S. stock market got off to a bumpy start in 2024 Q2. No sooner did the calendar flip to April and the S&P 500 descended into a pullback. Over the course of the first fifteen trading days of the new quarter, the S&P 500 retreated by nearly -6%. Knowing that stock market corrections within a broader uptrend last anywhere between two to eight weeks with declines ranging from -5% to -12% along with the fact that the pullback was long overdue by a number of technical measures, it was reasonable to wonder whether we might see another tough quarter for stocks reminiscent of the stretch last August through October dropped by -11%. Turns out, not so much, as we appear to have a renewed upside breakout in U.S. stocks.

Breakout. So what has taken place in recent weeks to inspire the breakout discussion? After bottoming intraday on April 19 at 4953, the S&P 500 has been on the upside attack. It rallied for five out of the next six trading days through April 29 to reach 5123 and join a battle with its medium-term 50-day moving average resistance, which is the blue line on the chart below. If the S&P could advance decisively above this key trend line resistance, it would signal that the rally dating back to October 30 was back on. Conversely, if the S&P 500 fell back, it meant that further selling pressure needed to be wrung out of the market before it was ready to resume its uptrend.

Over the next three trading days through May 2, the S&P 500 retreated back to 5011, but by the end of the day last Tuesday, it was surging back to the upside. And by Friday, the S&P 500 made its decisive move above its 50-day moving average resistance to reclaim the uptrend.

The fact that the S&P 500 has been able to reclaim its 50-day moving average support line so quickly following an extended rally five months prior that saw the headline index gain more than +28% is not only impressive but decidedly bullish for the stock market to continue its gains into the summer months.

But despite its initial strong surge, is the breakout confirmed? Not quite yet.

Seeking confirmation. It is worthwhile to note that while the S&P 500’s surge above its 50-day moving average is indeed a great start, more needs to take place before we can get too comfortable that a breakout has taken place. Not only does the market need to advance above this line, it needs to do so decisively and sustainably. We got the decisive part last Friday, but the market needs to spend at least a few more trading days above its 50-day moving average and continue its advance higher before the breakout is fully confirmed.

We can examine other related signals as well to help determine whether the breakout is likely to hold. For example, we can look at U.S. mid-cap and U.S. small cap stocks as measured by the S&P 400 and S&P 600 indices, respectively, to see how these markets are performing from a breakout perspective. And in both regards, we find additional good news.

In the case of mid-caps, they broke out above their 50-day moving average resistance even more decisively. And the retreat taking place on Wednesday would be considered modest at best.

Same holds true even more so for small caps. Long the laggard relative to large caps and mid-caps, they had the most definitive breakout above resistance of them all.

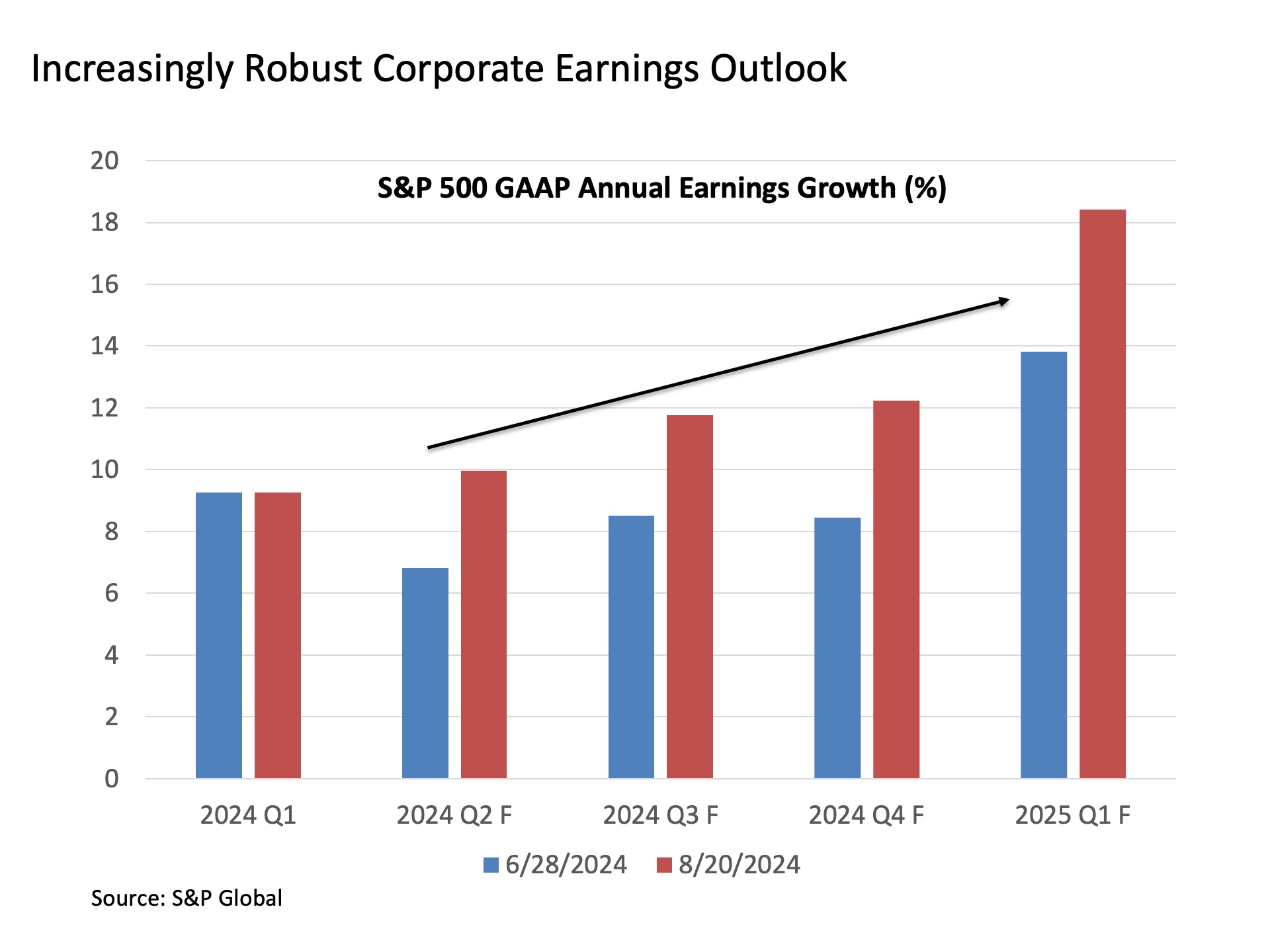

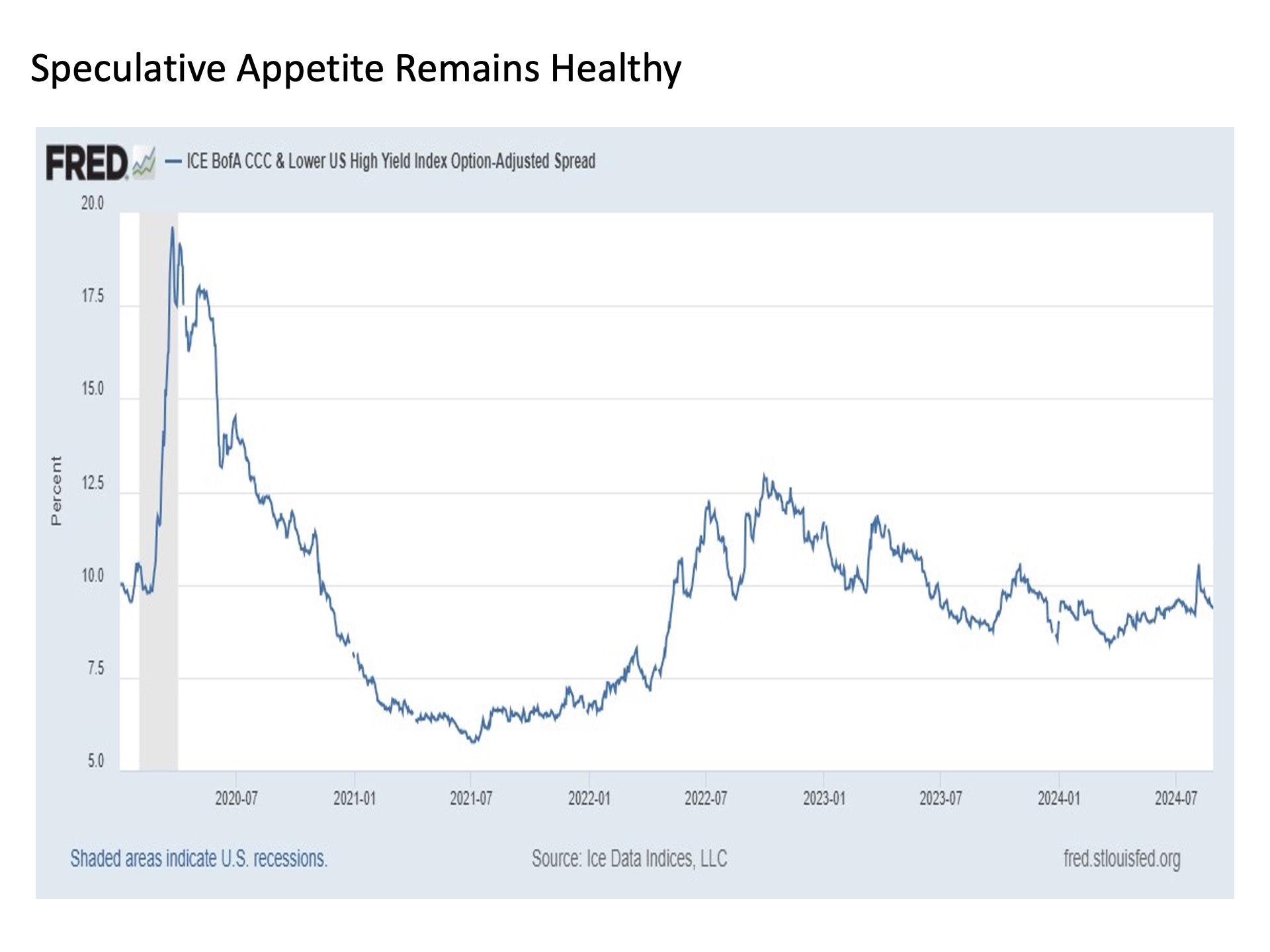

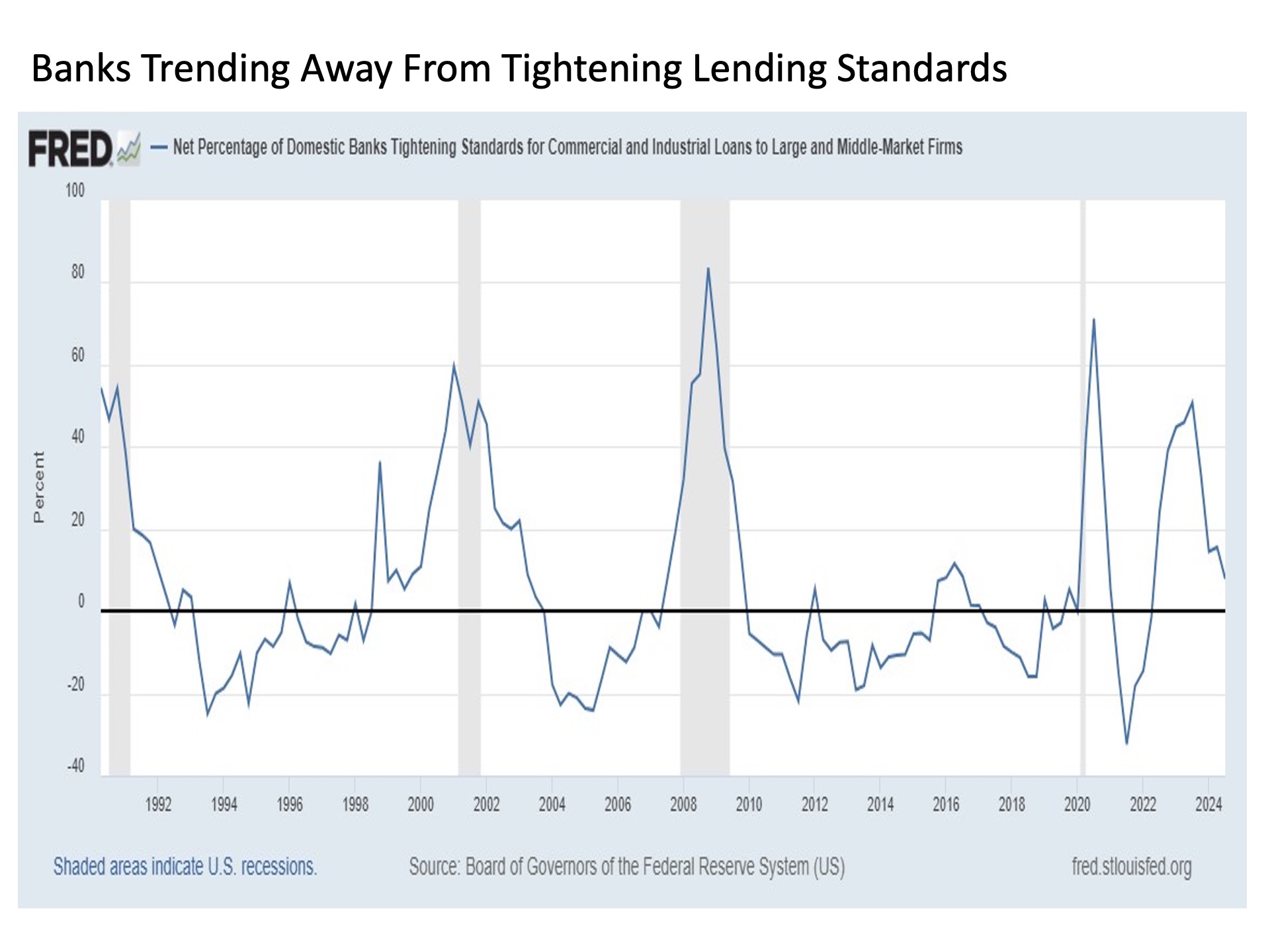

The relative strength in the breakout of mid-caps and small caps is a particularly good sign for large caps, as these smaller sized areas of the market have a history of leading the broader market over time. Moreover, the underlying economic and corporate earnings fundamentals support the continued upside scenario, as 2024 Q2 economic growth projections remain more robust than expected and corporate earnings continue to rise at a low double-digit rate at a time when inflationary pressures continue to ease, albeit more gradually than originally anticipated, but still easing nonetheless.

Next hurdles. So what are the next hurdles ahead for a U.S. stock market that appears poised to return to rally mode? The good news is that a number of tailwinds remain at the market’s back.

Following the upside burst in recent days, the S&P 500 also cleared its short-term 20-day moving average resistance (dotted green line) dating back to early April and in the process reached the top end of its Bollinger Band range (top solid green line). As a quick overly simplified explanation, Bollinger Bands show where the S&P 500 should reasonably be expected to trade 95% of the time – thus stocks should reasonably be higher than the top green line 2.5% of the time and below the bottom green line 2.5% of the time. In short, hitting the top band indicated the market was overdue for a quick breather, which played out on Wednesday.

Beyond the overdue immediate pause, markets still have a number of indicators suggesting further room to move to the upside. The Relative Strength Index (RSI) is now back in bullish territory with a reading above 50, but at 59 still has a lot of room to rise before reaching an overbought 70 reading. Money flow is no longer negative as indicated by the red valleys at the bottom of the chart above, but we are far from having money flow rise into the green mountains that have driven past rallies. And the 20-day and 50-day moving averages that were resistance as recently as a week ago are now serving as trendline support to help steady the market on its latest advance.

Bottom line. While we are still awaiting final confirmation, initial signals suggest that the recent market pullback in early April is fading into the rearview mirror. This is a positive sign for stock investors as we move through May and into the early summer months.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Approval #: 574524-1