It is the Fourth of July holiday in the United States. With this spirit in mind, it is a good time to take a look at how well the U.S. stock market continues to move independently from the rest of the world in keeping with a tradition that has gone on for many years now.

Long-term outperformance. It has been a trend that is now decades in the making. The U.S. stock market as measured by the S&P 500 Index has dramatically outperformed its global peers. One has to look no further than the cumulative returns of U.S. stocks relative to their non-U.S. counterparts since the start of the last decade to see how profound this outperformance has been.

What has been driving this phenomenon? It has been several factors, particularly since the calming of the Great Financial Crisis.

First, the United States remains the largest and most established and liquid financial marketplace in the world. It is a place where capital can go to be treated best. While the U.S. may not be as fiscally healthy as it has been in the past, it remains the global safe haven destination for investors over all other markets.

Second, the U.S. has been the logical destination for a global economy awash with excess liquidity looking for a home. Regardless of where easy monetary and/or fiscal policy has emanated, more often than not this excess liquidity has made its way around the world to U.S. markets either directly or indirectly.

Third, the U.S. remains at the global forefront in terms of economic growth and technological innovation. Unlike many leading economies in other parts of the world that have been coping with varying degrees of fiscal and/or competitive stress, the U.S. markets remain the driver of global growth and leading the expansion into new business opportunities.

Lastly, although economic growth has been sluggish and uneven since the aftermath of the Great Financial Crisis, it has been relatively steady supported by chronically low interest rates up until the last couple of years. And even after the inflationary outbreak in recent years shook financial markets and drove core interest rates measurably higher, the United States economy remains the bastion of stability relative to the rest of the world.

U.S. bias. Eventually the global economic tide will turn. I can still remember like yesterday the 1980s and early 1990s when the primary concern was how the United States was falling behind the rest of the world in terms of potential economic growth and innovation. History has shown that global leadership constantly evolves and inevitably we will reach a point where other parts of the world overtake the U.S. This, of course, has been a persistent concern among economists and investors for years related first to Japan, then Europe, and more recently China. While no such shift has yet to come to pass, a new wave of global competitors such as India are gradually making their way to the forefront of the discussion today.

In the meantime, the U.S. bias in asset allocation portfolios continues to be rewarded. And this is likely to be true in the near-term as many other parts of the world continue shifting toward deglobalization, changing geopolitical threats, and political and economic change.

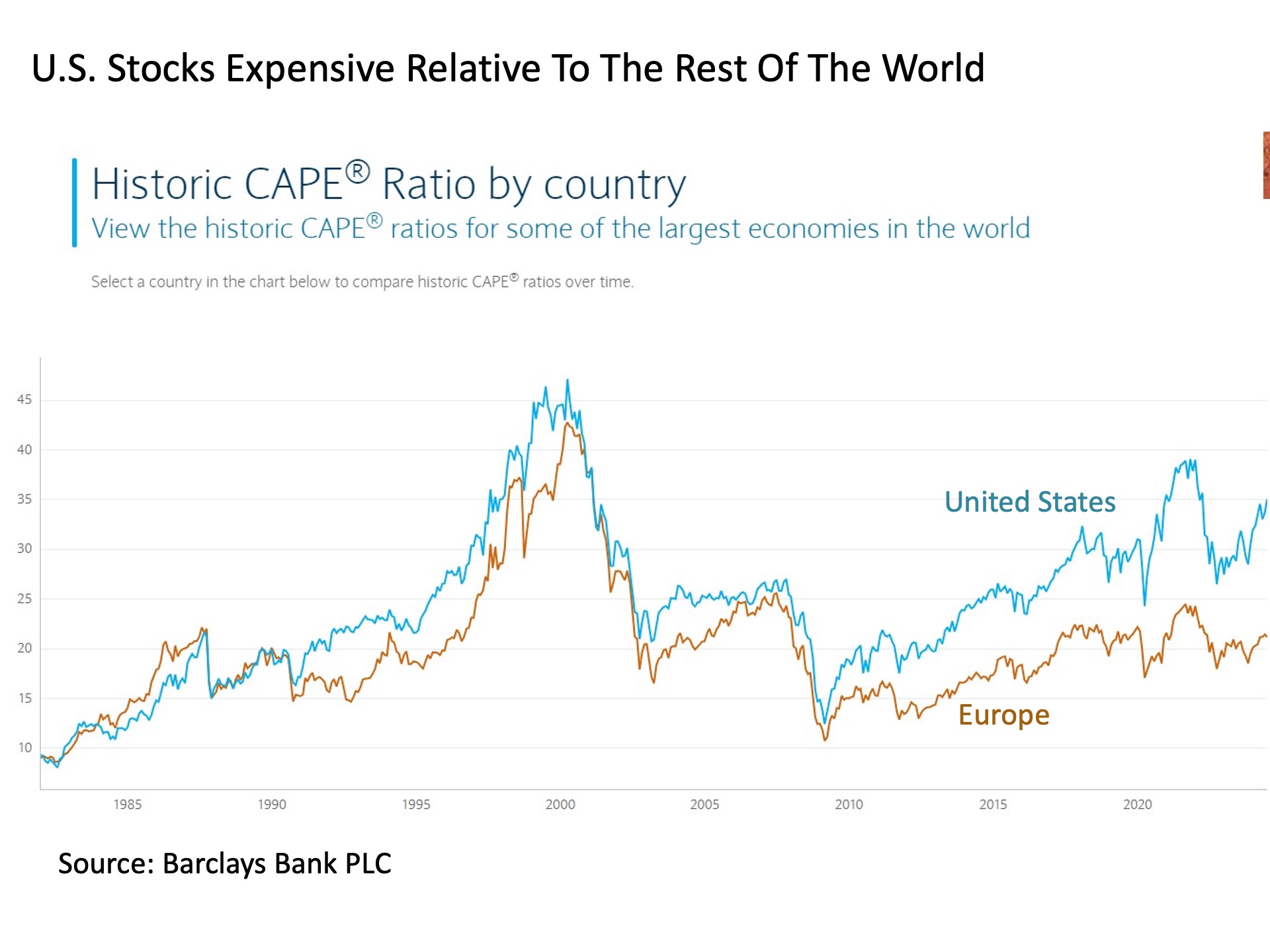

At what price? An additional headwind confronting the continued U.S. bias going forward is the increasingly widening valuation gap between U.S. stocks and their non-U.S. counterparts. For example, historically U.S. and European stocks traded comparably on a cyclically adjusted price-to-earnings (CAPE) ratio basis. But since the start of the last decade, these two markets started to deviate. Today, while Europe trades at what would historically be considered an expensive 21 times CAPE ratio, the U.S. is vastly more expensive with a CAPE at 35 times.

Thus, non-U.S. stocks have a distinct valuation advantage over U.S. stocks once the time comes when the rotation out of the U.S. and into developed international and/or emerging markets finally takes place. The only question is when, for non-U.S. stocks have shown this valuation advantage for many years now, yet the gap keeps widening.

Bottom line. As we celebrate Independence Day here in the U.S., we can look forward to the second half of 2024 with forces still in place that support a U.S. bias in equity portfolios relative to the rest of the world.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 597032-1