History does not repeat, but it sure can rhyme. We are heading into the prime of the political election season, and with the various speeches and pontifications from our leading candidates comes statements that end up having meaningful market consequences. The latest such example came this week, but it’s not the first time we’ve seen such market swaying events. What, if anything, can we take away from recent past episodes?

“Taiwan should pay us for defense”. Republican presidential candidate Donald Trump, who is currently leading in the polls with the election four months away, shared this sentiment when sitting for an interview with Bloomberg Businessweek this week. Semiconductor stocks were sent reeling to the downside on Wednesday and Thursday following these remarks. Why? Because Taiwan is essentially the global epicenter of the semiconductor industry, and it remains under looming threat of China seeking to reclaim full control of the island the same way they swept into Hong Kong a few years ago, which would likely be highly disruptive to global chip production and distribution. Overall, semiconductor stocks as measured by the Philadelphia Semiconductor Index have plunged by as much as -9% in the past two trading days and have fallen by as much as -10% from their peaks just a week ago.

The plunge in semiconductor stocks is particularly notable for the following reason. These are the same highly cyclical and economically sensitive stocks that have been the primary drivers of broader stock market gains for much of the past year driven by the belief that the proliferation of Artificial Intelligence powered by these computer chips will transform the world. How much have market gains depended on these chip stocks? NVIDIA alone has recently accounted for as much as 40% of the entire year to date gain in the S&P 500 Index in 2024. In short, it has been profound.

“Price gouging like this in the specialty drug market is outrageous”. This is not the first time we have seen major political figures roil high flying segments of the stock market with their passing comments. It was nearly nine years ago in September 2015 when then Democratic presidential candidate Hillary Clinton, who at the time was considered to have a reasonably high probably to assume the presidency following the 2016 election, made the price gouging declaration on Twitter targeting the biotech industry, followed by the comment “Tomorrow I’ll lay out a plan to take it on”.

Much like semiconductor stocks this decade, biotech shares were the high flyers of the first half last decade based on the premise that the innovative medical advancements from these companies would change the world. But having just topped out a couple of days earlier, biotech shares started plunging to the downside following Clinton’s remarks. Over the course of the next eight trading days, the passing comment from a person that might become president more than a year later (and eventually did not become president) helped send biotech shares lower by nearly -20%. And biotech shares continued to slide in the months that followed, falling by as much as -42% over the next five months before finally finding a bottom. More than two years later in late 2017, biotech stocks were still trading below their peak 2015 levels.

Will history rhyme this time? It remains to be seen whether richly overvalued semiconductor stocks will suffer the same fate following the passing comments of a leading presidential candidate that richly overvalued biotech stocks endured following the passing comments of a leading presidential candidate less than a decade ago. The following are some key metrics to monitor whether chip stocks can regain their footing and continue their bold march higher or whether Trump’s comments end up being the catalyst for an arguably long overdue consolidation in semiconductor stocks similar to the long overdue consolidation in biotech shares back in 2015.

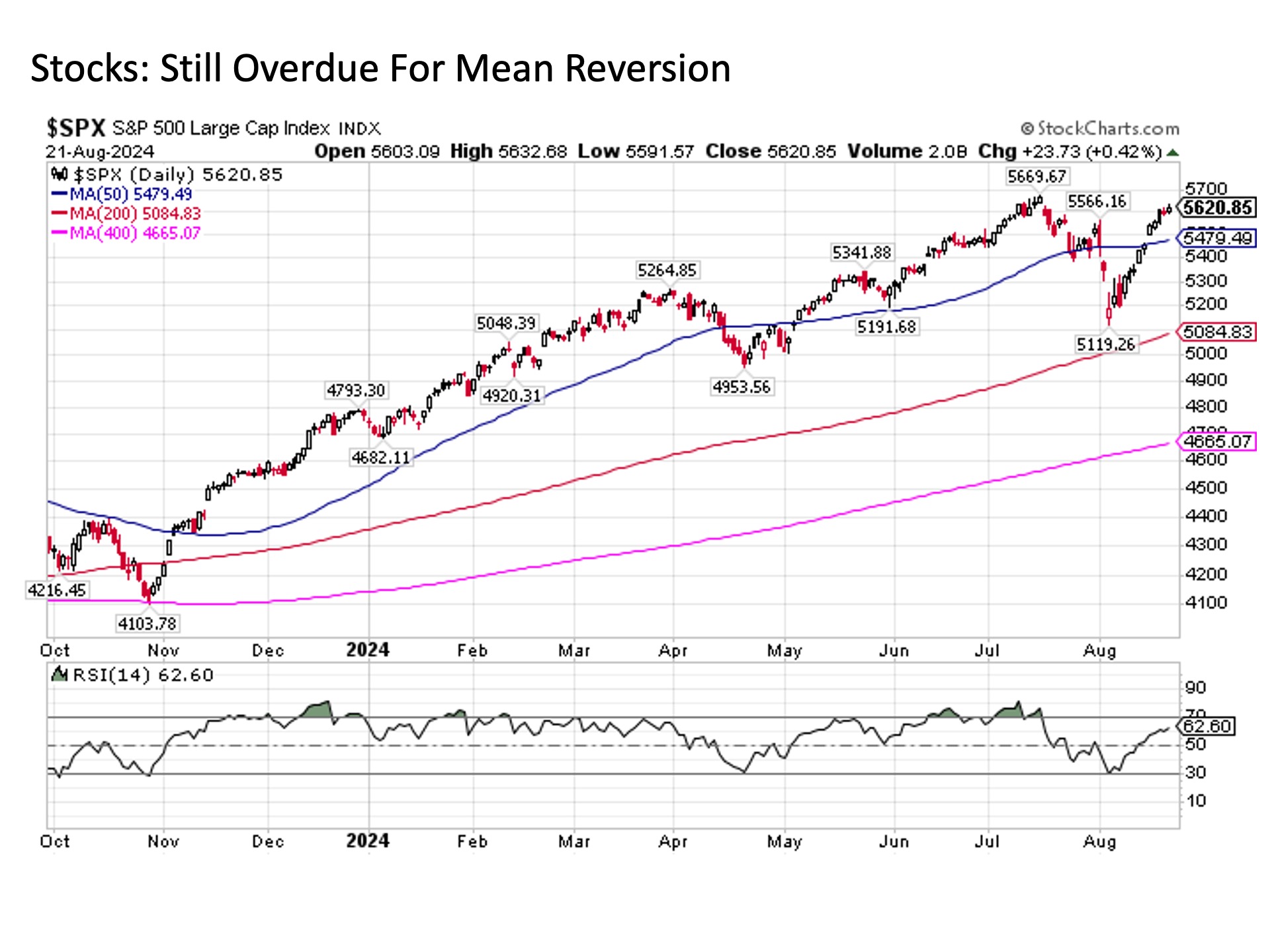

First, chip stocks found their footing on Thursday at their upward sloping 50-day moving average (blue line on chart above), which is a positive response to key technical support level. With that said, the initial bounce was relatively weak, so it will be worth watching whether chip shares slide further into early next week. If so, further and more sustained downside should be expected.

Next, if semiconductor stocks break support, the next stop to the downside at the 200-day moving average (red line) could see as much as -25% come off of the semiconductor stock index. Even with such a decline, the uptrend in chip stocks would still remain in a longer term uptrend. That’s how much semiconductor stocks have gotten way ahead of themselves in the current rally.

Finally, it was not that long ago in 2022 when semiconductor stocks lost roughly -50% of their value peak to trough (such is the nature of owning shares in a highly cyclical and economically sensitive industry like semiconductors). This includes shares of today’s investor fave NVIDIA, which dropped nearly -70% in less than a year from November 2021 to October 2022. Much like biotech shares from nearly a decade ago, investors must be prepared for the fact that the risk that gives us such high flying gains is a double edged sword that can be followed by crushing declines.

Bottom line. Whether presidential candidate Trump’s comments on Taiwan will ultimately be the catalyst that pricked the bubble in semiconductor stocks similar to how then presidential candidate Clinton’s comments popped the bubble in biotech stocks roughly a decade ago remains to be seen. But if this comes to pass, it has the potential to bring with it some long overdue rotation within the market and perhaps some healthy broadening of performance across stocks beyond the few high flying names that have driven gains up to this point. Keep a close watch in the coming weeks.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 605562-1