The sudden and sharp stock market correction that marked the beginning of August has quickly become a distant memory. Elevator down, elevator back up with the S&P 500 having gained in 10 out of the last 12 trading days and once again pushing new all-time highs in the process. What can we reasonably expect from capital markets as the summer starts to wane and the leaves on the trees start to turn in the fall.

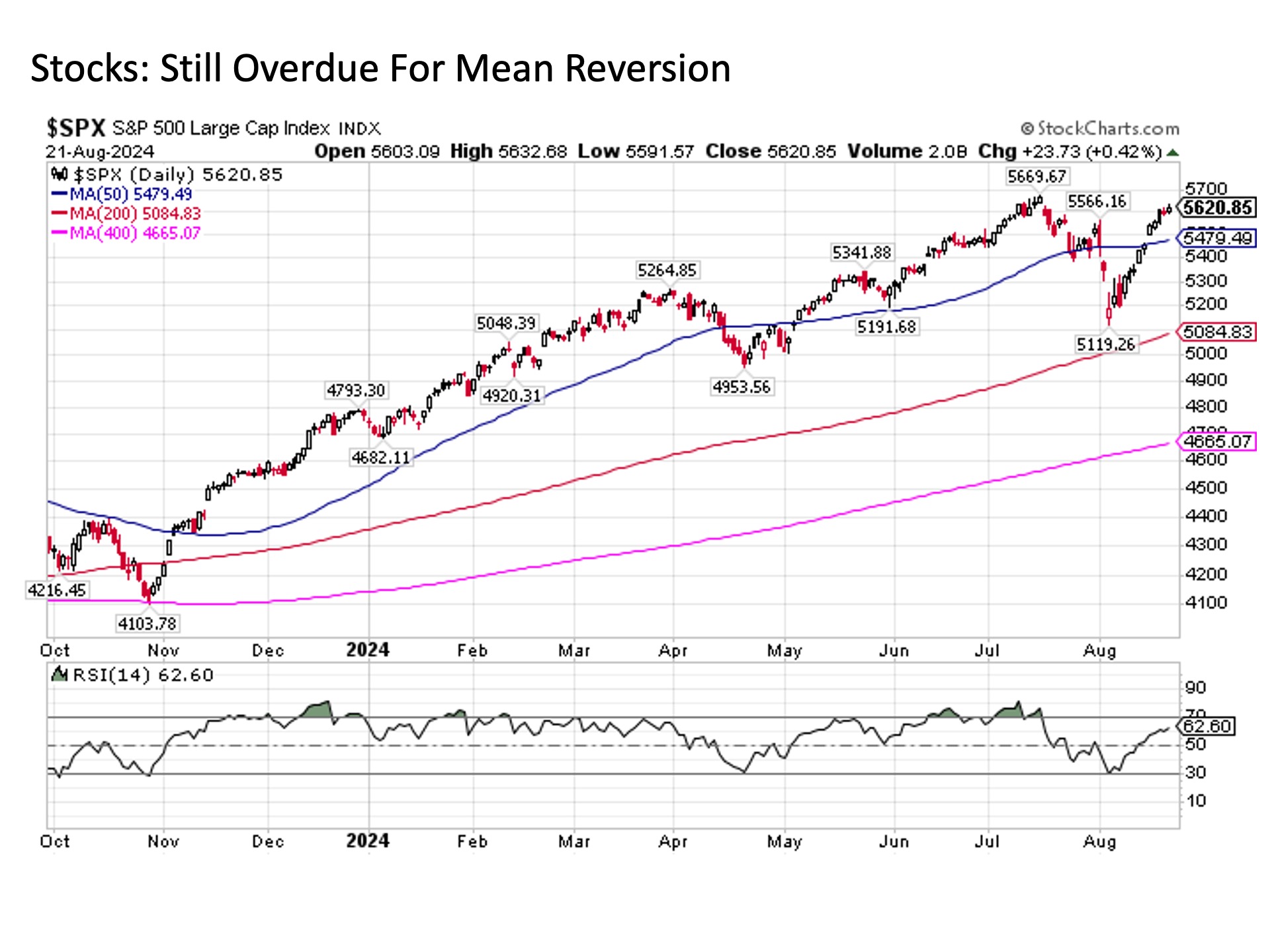

Risks. Is the stock market still exposed to the risk of a measurable short-term correction? Absolutely. Despite briefly letting off some steam at the start of August, the S&P 500 is once again back to trading well above its long-term trendlines as measured by its 50-day (blue), 200-day (red), and 400-day (pink) lines in the chart below.

We could see as much as 1000 points come off the S&P 500, or roughly -17% lower from current levels, and the market would still be in an uptrend. That’s how far ahead of itself the market has been running since the lows from last Halloween. This raises an important point – short-term corrections, even if they are meaningful, are a part of a healthy long-term bull market. So even if we see more than -10% come off the market over a two to eight week period in the coming months, it would still be in the context of a market that is still striding boldly higher.

Rewards. So how can we be so sure that any such short-term correction isn’t the start of something more meaningful to the downside? Underlying circumstances can certainly change, and we monitor market conditions on a daily basis for any changes in the tides. But the good news is that underlying market fundamentals remain highly favorable on a variety of fronts.

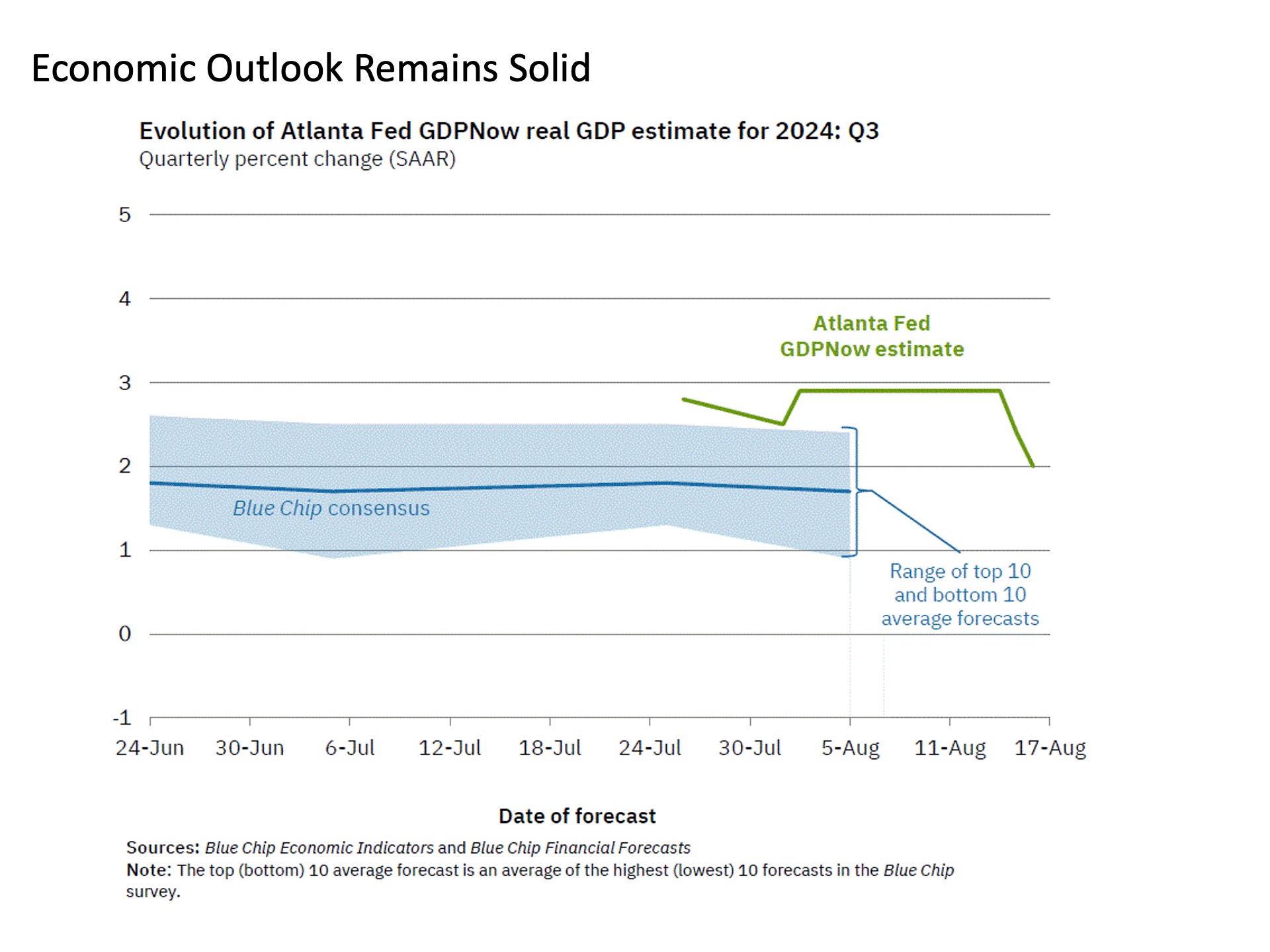

First, the U.S. economic growth outlook remains solid despite the ongoing concerns about an economic slowdown in the months ahead. This is highlighted by the latest forecast from the Atlanta Fed GDP Now, which continues to project a steady +2% economic growth clip for the current quarter. This is the type of ongoing growth rate that is supportive of a healthy market and corporate earnings outlook.

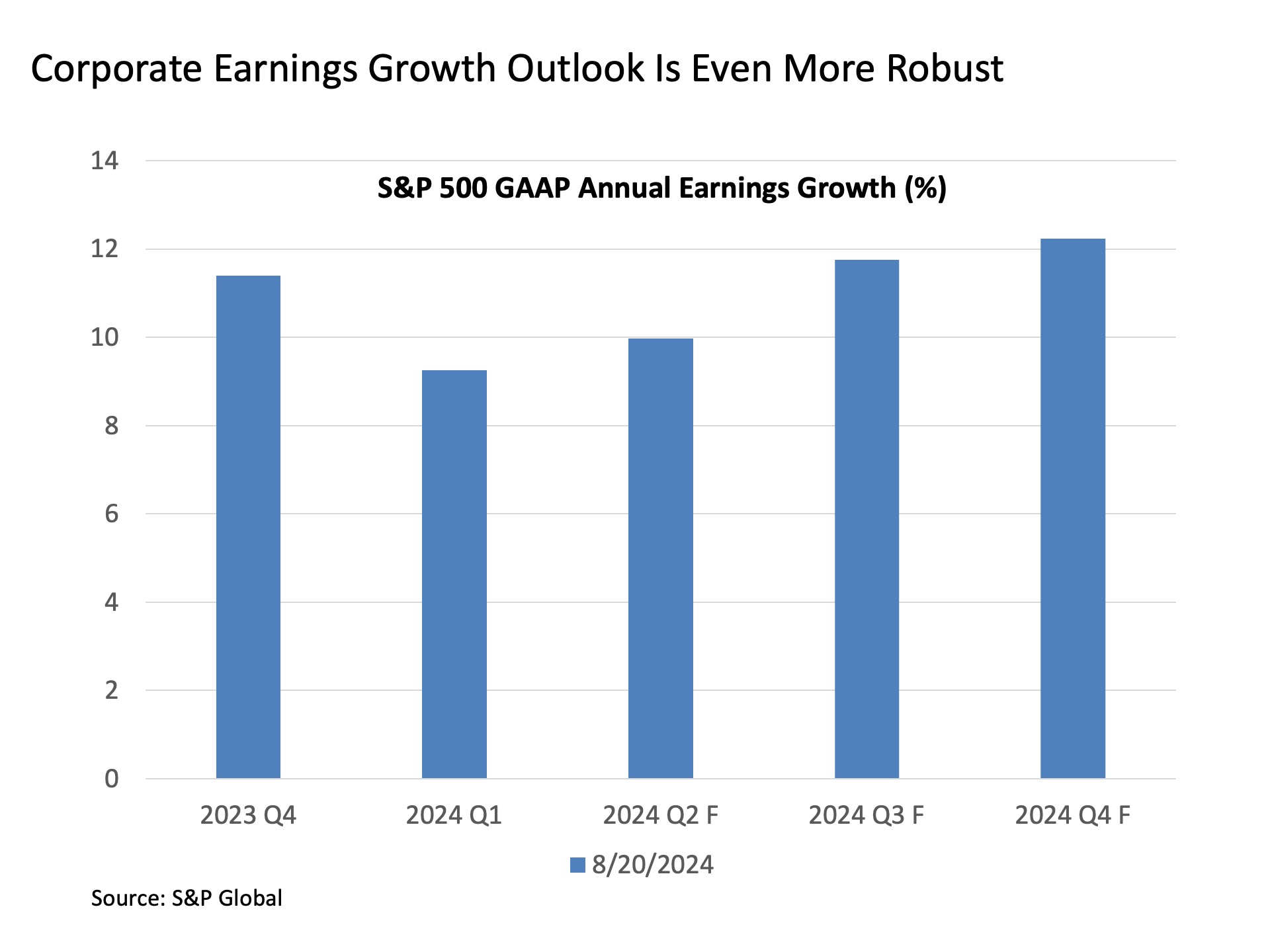

About corporate earnings, this more than anything else is the key fundamental driver for higher stock prices. And the good news is that coming out of the latest earnings season for 2024 Q2, the corporate earnings growth outlook was revised measurably higher, providing even more fuel for higher stock prices. Not only are year-over-year as reported corporate earnings set to rise by +10% once the current earnings season officially draws to a close, but earnings growth for the remaining two quarters of the year in 2024 Q3 and Q4 are set to increase at an annualized +12% rate. Double-digit annual earnings growth is historically a great catalyst for higher stock prices.

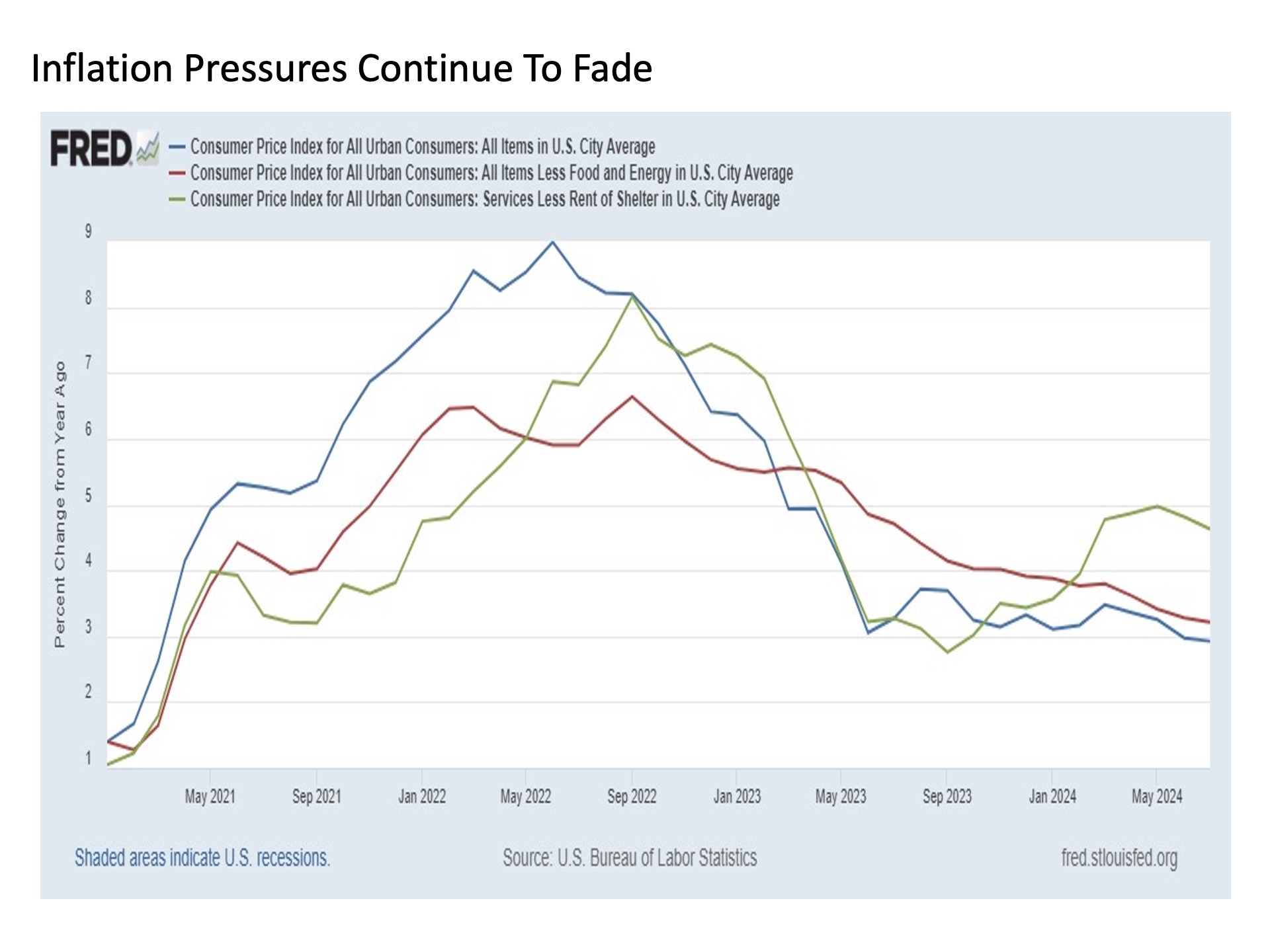

What about that primary downside risk for stock prices that we have been preaching for more than a year now in the form of a renewed rise in inflation? The good news for stocks is that inflationary pressures continue to fade from the peaks that we saw roughly two years ago now. This is true both on a headline (blue) and core (red) basis in the chart below. And even the services inflation (green) that has been lingering on the risk radar screen for months now appears to have peaked and is starting to roll back over. These waning inflation pressures are not only good for the economy and stock prices, but they provide the U.S. Federal Reserve with increasingly flexibility to inject even more liquidity in support of financial markets in the form of rate cuts, of which as many as three to five are anticipated by the market between now and the end of the year.

Bottom line. Could we see another sharp stock market correction in the months ahead? Certainly, as the market has been running hot for many months now. But it remains important to keep in mind that short-term corrections, even double-digit corrections, are a natural part of long-term bull markets. And as head toward the end of August and the months to follow after, the good news is that the economic, earnings, and inflation outlook remain increasingly supportive of higher stock prices beyond any short-term market pressures we might face.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 619380-1