The time has finally come. At long last and following nearly two years of anticipation, the U.S. Federal Reserve is ready to begin delivering the interest rate cuts investors have longed for. While one could certainly quibble with whether starting into a rate cutting cycle today will be the wise move in the end with economic growth still strong and percolating inflation pressures still lingering beneath the surface, the fact is these rate cuts are almost certainly coming when the Fed emerges from its latest policy meeting on Wednesday, September 18. While stock investors may see this as the latest reason for wild optimism, history suggests that we should be careful what we wish for when it comes to Fed rate cuts.

Steepening. Investors have been conditioned for the last 15 years to think that the Fed cutting interest rates is a good thing. Under the investor preface that “bad news is good news”, whenever the economy hit a minor pothole in the post Great Financial Crisis (GFC) period, the U.S. Federal Reserve would come rushing back in with policy easing including rate cuts if they were available and quantitative easing liquidity injections to keep the economy and its financial markets afloat.

But it is important to highlight a key difference between the rate cutting cycle that we are about to enter into versus what a whole generation of investors have come to know over the last decade and a half. For the many years since the GFC, the Treasury yield curve, which is the difference between long-term yields in the 10-year U.S. Treasury yield and short-term yields in the 3-month Treasury yield, was consistently steep. This signaled that were consistently in a phase of economic recovery and growth, albeit chronically slow and sluggish, coming out of the GFC. Put simply, markets had already ingested its monetary policy medicine in the form of aggressively easy monetary policy in response to the GFC, and it was slowly on the mend in the years since.

This is in sharp contrast to what we are entering into today. The outbreak of the scorching case of inflation earlier this decade finally broke the post-GFC economic malaise fever, and the Fed was forced to finally raise interest rates aggressively off of the zero bound to as high as 5.50%. This led to an inverted yield curve where investors were getting paid more in yield for owning T-Bills paid back to them in 3-months than the yield from loaning money to the U.S. government for 10-years. This is an unusual circumstance (usually investors get paid a “maturity premium” for having to wait longer to receive their money back) that has happened in the past but only under specific circumstances. When has this taken place? In the time period not long before descending into economic recession.

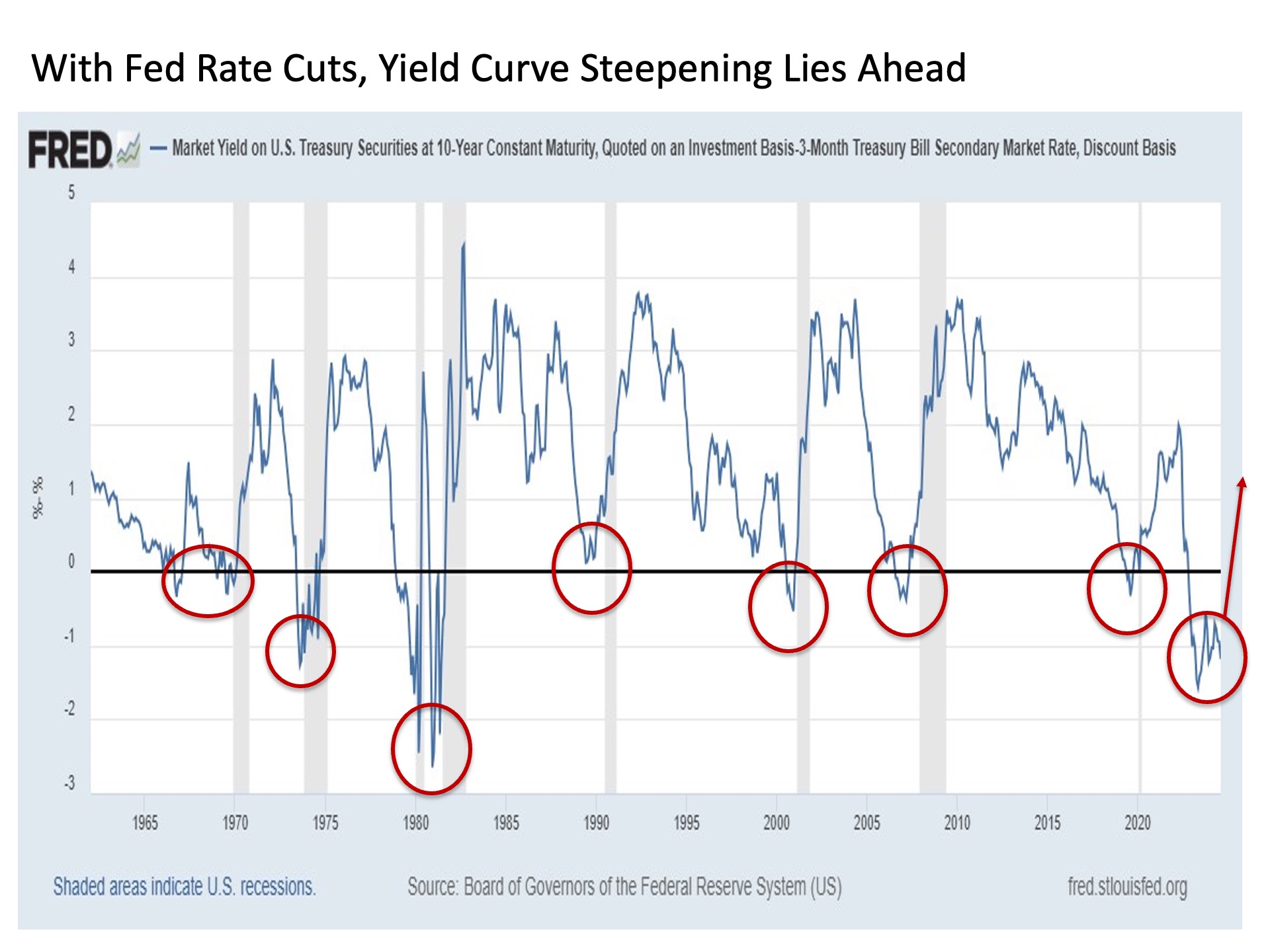

The chart above shows the seven past instances over the last 60 years when we have had a similarly inverted yield curve. One point is immediately evident when examining these past periods. In each of the last seven instances when the yield curve shifted from inverted to steepening, which results from the Fed cutting interest rates and bringing down the short end of the curve, the U.S. economy subsequently descended into economic recession. The economy receiving its monetary medicine to combat recession is shown by the gray shaded areas on the chart.

Rock climbing. The second impact from these yield curve steepening periods is likely much more relevant to stock investors. Yes, the Federal Reserve is about to start injecting a big dose of liquidity to boost the economy with feed through effects to financial markets. But history has shown that the stock market initially struggles with the adjustment to the reality of an economic slowdown before it finds its footing and resumes rising on the wave of recovery. And this historical fact from the pre-GFC period is seemingly being overlooked by many investors as we enter into the next dramatic steepening phase.

Consider the following. During each of the last seven episodes when the Treasury yield curve sharply steepened, the US stock market subsequently descended into a peak to trough decline of -28% on average, which is full fledged bear market territory. With the exception of the COVID crisis that was truncated by the massive deluge of emergency liquidity that played a meaningful part in the subsequent inflation that followed, the average duration of these past yield curve steepening bear market episodes was 18 months.

In short, history has shown that when the Fed finally gets to the point where it is cutting interest rates, an extended period of stock market indigestion typically follows before the liquidity euphoria of higher stock prices finally takes hold.

Quickdraws. The latest upcoming phase of yield curve steepening could certainly be different. After all, we’ve seen a lot of unprecedented market reactions in recent years versus historical norms. But suppose a long overdue period of stock market turbulence lies ahead. What are ways that investors can successfully traverse such an environment?

The first is the diversification that comes from asset allocation. Many asset classes outside of stocks have historically performed particularly well during these yield curve steepening periods. These include long-term U.S. Treasuries and precious metals including gold, both of which have a historical track record of posting impressive gains during these same periods. An important key for these categories is whether inflationary pressures can remain in check as the Fed cuts interest rates and the yield curve steepens.

The next is the composition of stock allocations. Stock market sectors that have historically struggled during these past yield curve steepening episodes happen to be the same sectors that have been skyrocketing to the upside over the past year. These include information technology in general and semiconductors in particular. Communications services and consumer discretionary have also historically been hit more directly during these periods. So what sectors historically perform relatively well during these periods of yield curve steepening? The more defensive and countercyclical sectors of consumer staples, health care and utilities. Dividend growers and those with wide economic moats and pricing power perform particularly well during these more challenging periods.

Bottom line. Long awaited interest rate cuts are finally arriving at an economy and investment market near you. While investors may perceive the start of this new phase as good news, history has shown that it can be anything but for the more speculative stock investors among us. Now is arguably a time more than most where investors may be well served to reevaluate their current allocations and reaffirm their dedication to a broadly diversified long-term investment plan.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 629447-1