The U.S. stock market continues to claim new all-time highs. But another segment of capital markets is also glistening brightly as we continue through 2024. It is the precious metals market including gold and silver. Even if you are not allocated to these more specialized categories, they can still provide important information to guide investor decision-making with their traditional investments.

All that glitters. U.S. stocks have been a sterling investment since the turn of the millennium. Consider that the S&P 500 was trading just above 1000 as we entered the 2000s and traded as low as 667 along the way, yet is pressing toward 6000 as the first quarter of the 21st century draws to a close. Phenomenal performance to say the least. But despite these gains, it is surprising to many investors to learn that the precious metal of gold has performed measurable better over this same time period. For while the S&P 500 has posted a cumulative total return north of +500% since 2000, gold has advanced by more than +800% cumulatively over this same time period

While the precious metals market just like U.S. stocks have certainly had their stumbles along the way over the past 25 years, it is worth noting that both have been shining bright so far in 2024. Whereas the S&P 500 is up over +24% year-to-date, which is impressive in its own right, both gold and its higher beta counterpart silver are higher by +30% or more so far this year.

The fact that investors have two distinctly different segments of the market that are virtually uncorrelated with each other in terms of their price performance that can generate such impressive returns highlights the merits of broad portfolio diversification and the value that can be added from considering the full landscape of categories when managing the asset allocation process on a risk-adjusted basis.

How do you measure its worth. Of course, many investors are not allocated to some of the more specialized areas of capital markets such as precious metals. But even if you are exclusively focused on stocks and bonds does not mean that one cannot derive worthwhile information from the price performance exhibited by precious metals like gold and silver.

So what is the messaging that gold and silver are sending to investors today?

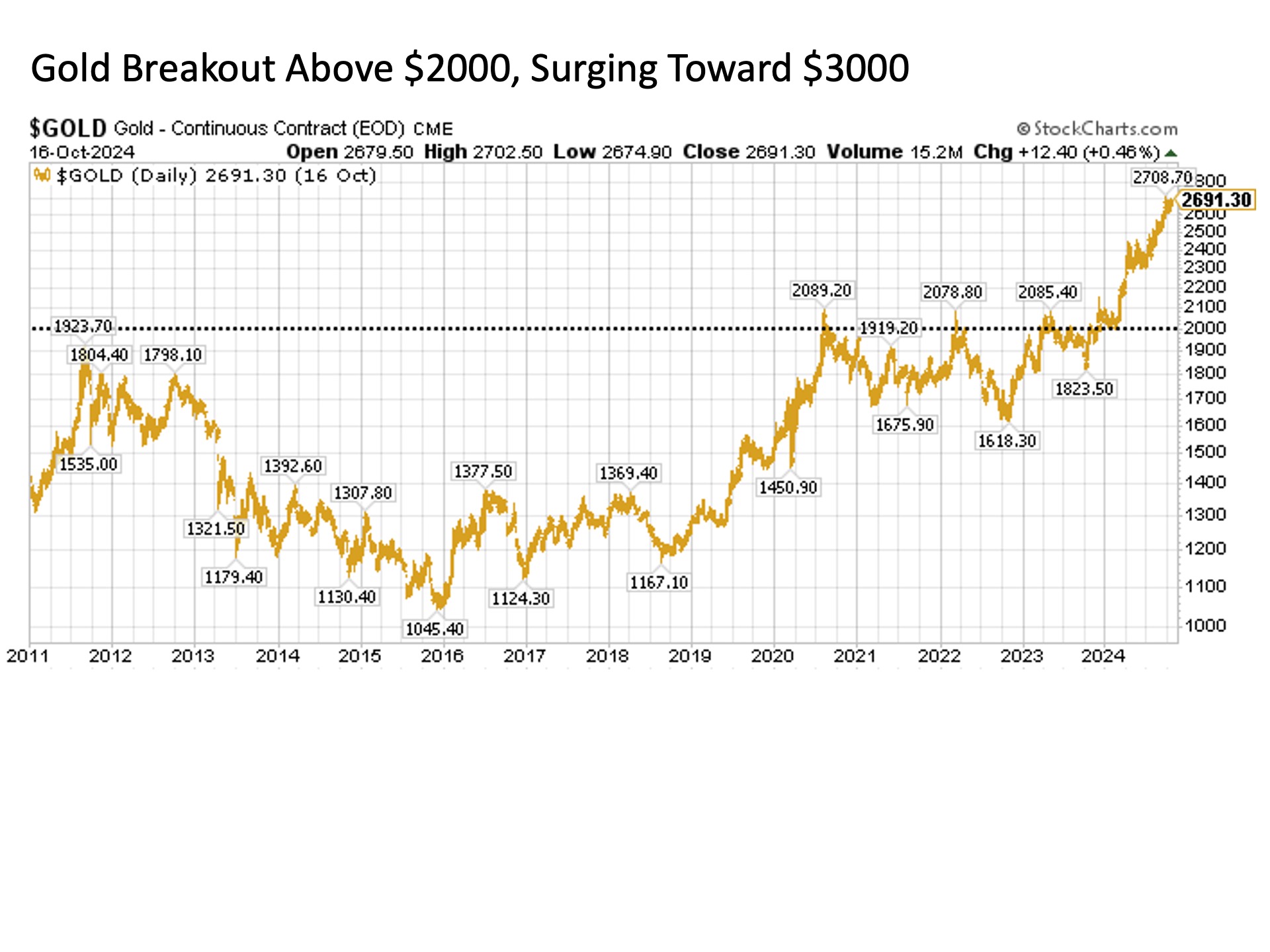

Let’s start with gold. Here is an asset that spent the last 13 years struggling to break out above $2,000 per ounce. But in 2024, not only did gold break out decisively to the upside, it appears on a fast track to test the $3,000 level in the coming months. In short, it is on fire.

Now many investors may view this run in gold as a signal that inflation problems may lie ahead. After all, history has supposedly taught us that gold is the classic hedge against inflation. This point is based in truth, but a number of qualifiers must be applied for context. Gold is a hedge against inflation, but it is inflation that is running out of the control of monetary policy makers. This is what took place during the 1970s and early 1980s, and gold did phenomenally well during this time period. But if we have an outbreak of inflation and the market perceives that monetary policy makers are going to combat it aggressively – like raising the fed funds rate more than 5% in just over a year like they did starting in 2022 – then gold’s performance will be middling at best. Why? Because gold returns are also driven by the flow of monetary liquidity, and if the Fed is going to hike interest rates and thus drain liquidity, gold will get sold off in the process.

Instead, gold is a hedge not necessarily against inflation, but out of control inflation. It’s also a hedge against deflation like we saw in the 1930s and again in and around the Great Financial Crisis starting in the late 2000s. In short, gold is a hedge against economic instability.

So why then is gold performing well today? Because gold also benefits in an environment where monetary policy is easing – like the Fed cutting interest rates by 50 basis points in September after months of anticipation – and inflationary pressures are expected to remain under control – like the 5-year breakeven inflation rate still hovering just above 2%. Such is the environment that we are in today, and this is constructive not only for gold prices, but also stock and bond prices. In short, the rise in gold this year is sending a constructive signal to the broader capital market place that the Fed has the flexibility to continue easing monetary policy, that a renewed rise in inflation is not likely, and that the economy may hold up better than expected despite ongoing recession concerns.

Let’s take this one step further with a look at silver. Like gold, silver is a precious metal, but with some key differences. First, silver has much greater price volatility than gold. Thus, an allocation to silver is not for the faint of heart. Next, silver has a dual identity that can change at any point in time. Unlike gold that is only really used for jewelry, silver has a number of industrial applications. As a result, sometimes silver behaves like a precious metal, and other times it acts more like an industrial metal. Thus, if silver is surging higher, it’s not only confirming the signals provided by gold, but it brings additional messaging with it.

So what can we take away from silver’s strong surge in 2024? That while the economy may slow as we make our way into 2025, that the economy is likely to hold up better than expected and that the demand for raw materials from producers and manufacturers is not only likely to hold steady, but that it may experience a solid surge on the other side of the economic cycle once growth starts to reaccelerate.

Bottom line. It has been a phenomenal year so far for precious metals such as gold and silver. And even if you are not allocated to these areas of the market, they are providing important reassuring signals for the economic and market path ahead for both stocks and bonds.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 646474-1