When monitoring capital markets, strange and unexpected relationships can exist between two market segments. Correlation without causation? Perhaps, but these bedfellows often come together for understandable reasons when considered more thoughtfully. Three particular relationships stand out today as worth monitoring for risk and opportunity as we continue through the second half of the year and beyond.

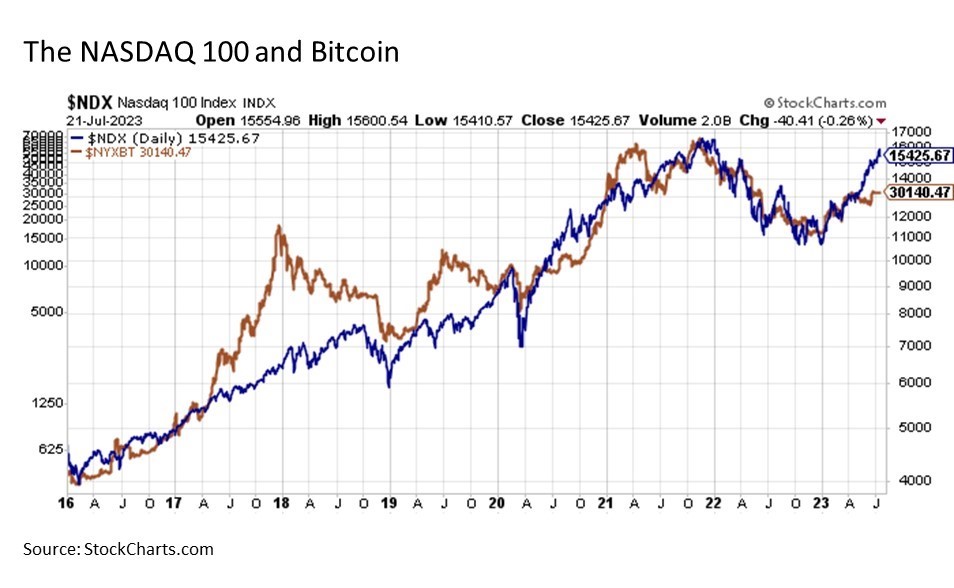

The NASDAQ 100 and Bitcoin. Technology stocks and cryptocurrency? At first glance, it seems these two buckets would have very little in common. But the NASDAQ 100 and Bitcoin do share one very important distinction that has them moving in virtual lockstep with one another, the latter with much greater price volatility, over the last seven years and counting as demonstrated in the chart below.

So what is it that brings the NASDAQ 100 and Bitcoin prices together in such a strong relationship? Because they are both measures of the magnitude of excess liquidity in the financial marketplace and its impact on risk asset prices.

When it comes to stocks, the most popular destination for excess liquidity has been big technology stocks. How else do we end up in a situation where the seven largest stocks in the U.S. today that make up a staggering 28% of the entire S&P 500 market cap weighting all hail from the NASDAQ and are all from technology (Apple, Microsoft, NVIDIA) or tech adjacent sectors (former tech sector heavyweights Alphabet and Meta Platforms now in the Communications sector and tech-focused consumer giants Amazon and Tesla found in the Consumer Discretionary sector).

As for Bitcoin, regardless of its long-term viability in potentially decentralizing business activity in many parts of the world, it is today the quintessential speculator’s instrument for the deployment of excess liquidity.

So what are these pair telling us today? First, that sufficient excess liquidity continues to course through the veins of capital markets as evidenced by both the NASDAQ 100 and Bitcoin advancing back to the upside thus far in 2023. Also, the fact that the NASDAQ 100 is now meaningfully leading Bitcoin prices should cause investors to take notice. If anything in recent years, the tendency was for Bitcoin to get ahead of itself before falling back to its NASDAQ 100 implied price. It remains to be seen whether tech stock prices fall back to their Bitcoin implied price, or whether Bitcoin catches up with the NASDAQ 100.

My base case? The mega cap tech stocks that drive the NASDAQ 100 higher have gotten waaay ahead of themselves with their AI related euphoria and are looong overdue for a breather and a period of consolidation, particularly at current frothy valuations. But recognizing that liquidity conditions remain abundant in asset markets despite the Fed’s best efforts, it would not be surprising to see the NASDAQ 100 and Bitcoin to meet somewhere in the middle over the course of the next six months to a year.

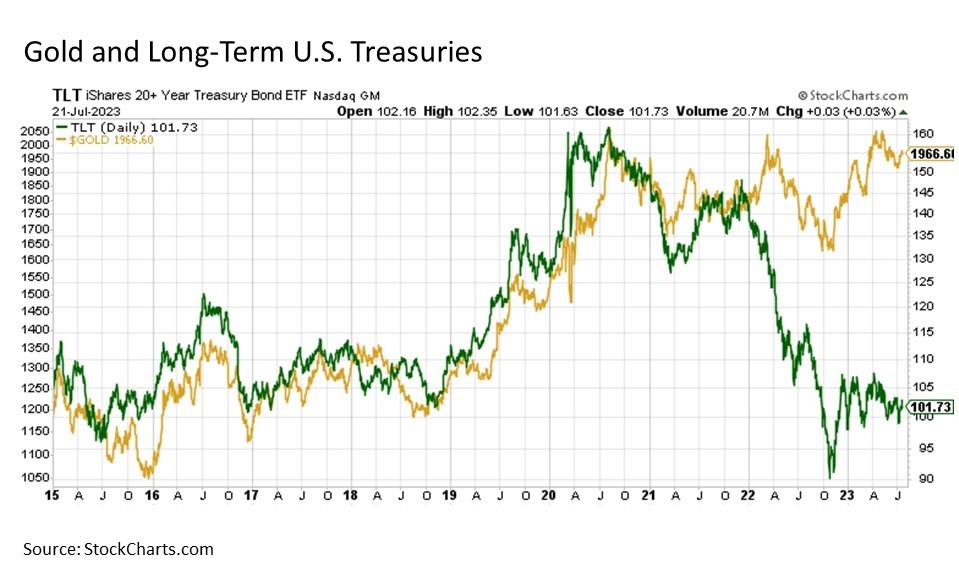

Gold and Long-Term U.S. Treasuries. So how exactly are these two related? On one hand you have gold, which is supposedly the legendary inflation hedge. On the other hand, you have long-term U.S. Treasuries, which are highly sensitive to the threat of inflation. Seems like they should be polar opposites of one another.

Upon closer consideration, we find that gold and long-term U.S. Treasuries have much more in common than one might initially think. While gold has garnered the reputation for its inflation protection chops, in reality it is far more a hedge against economic, market, and/or geopolitical instability. Such potential upheaval may include inflation as it did in the 1970s and early 1980s, but it may also include deflation as it did in the 1930s and the potential collapse of the global financial system as it did in the late 2000s in the midst and immediate aftermath of the Great Financial Crisis and again in the midst and wake of the COVID crisis in 2020. These characteristics bring gold much more in line with long-term U.S. Treasuries, which long has been and remains to this day a premier safe haven destination for global capital during periods of crisis and uncertainty.

Taking this one step further, gold actually doesn’t perform nearly as well as one might think during periods of high inflation despite its reputation. This is due to the fact that while gold prices may receive upward pressure from inflation, it is often neutralized if not more than offset by the drain in liquidity resulting from the U.S. Federal Reserve moving aggressively to raise interest rates to fight inflation. This helps explain why gold prices effectively chopped back and forth over the past two years despite the biggest bout of inflation in this country in more than four decades.

Putting this all together, gold and long-term U.S. Treasuries have much more in common than might reasonably be first thought. And the strength of this relationship over time is evidenced in the chart below, as the price of gold and long-term U.S. Treasuries moved in lockstep with one another from the start 2015 through the beginning of 2022.

Over the past 18 months, we have seen this once close relationship deviate widely with gold holding its ground while Treasuries plunged to the downside. This raises the key question? If these two unlikely bedfellows reconverge, will it be gold plunging down to the long-term U.S. Treasury implied price of $1,200 per ounce, or will it be long-term U.S. Treasury yields falling back toward the 2% range that was prevalent throughout much of the last decade prior to last year.

My base case? While inflation is likely to remain persistently higher than it was pre-COVID due to ongoing supply chain disruptions, chronic labor market shortages, and a global shift toward deglobalization and nationalism, pricing pressures are likely to remain muted by the chronically high levels of sovereign, corporate, and household debt that exists not only in the U.S. but across many parts of the developed and emerging world. As a result, my base case is that long-term U.S. Treasury yields will ultimately find their way lower and prices make their way higher to catch up with gold prices, particularly if the annual rates of headline and core inflation in the U.S. continues to make their way down the other side of the proverbial mountain from its mid-2022 peaks. With that said, if inflation pressures were to reignite in the second half of 2023, which is my primary downside risk to monitor in the months ahead, then all bets would be off.

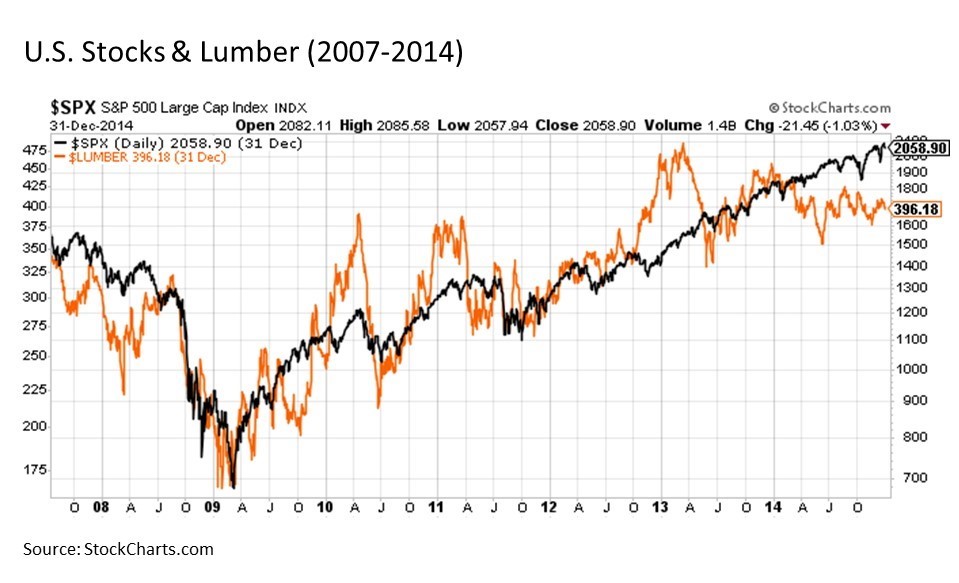

U.S. stocks and lumber. A third relationship worth monitoring going forward is that between the S&P 500 and lumber prices. The strong relationship between U.S. stocks and lumber prices over time is understandable upon further consideration. The housing market is a primary driver of the U.S. economy, and lumber is a primary input used in building and maintaining a home. Thus, if demand for lumber is rising, more homes are being built most likely in response to consumer demand. And if consumers that make up roughly two-thirds of GDP are buying more houses, this is supportive of sustained economic growth.

The following charts demonstrate this close relationship over time. The first is a chart showing the relationship between the S&P 500 and lumber from 2007 to 2014. While lumber shown by the orange line certainly traded with meaningfully greater price volatility over this time period, the relationship between the two was clearly very strong throughout the Great Financial Crisis period and its aftermath.

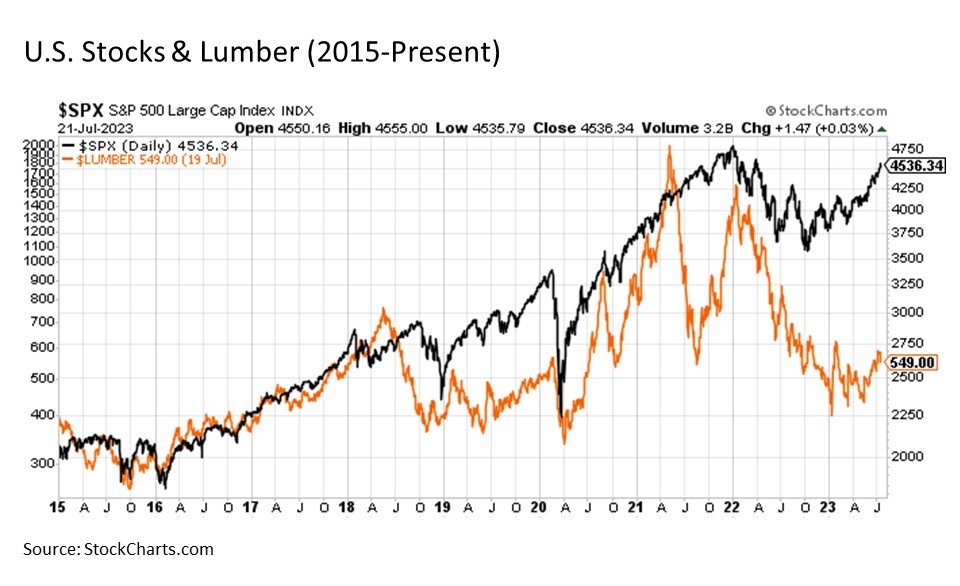

The next is a chart continuing forward this relationship between the S&P 500 and lumber from 2015 through to today. The correlation between these two bedfellows remained high through the summer of 2018. But then some meaningful deviations began to take place. Over the course of the next 18 months, lumber prices meaningfully trailed the S&P 500. That is until the onset of COVID and its associated recession sent U.S. stocks catching down with lumber prices.

Both U.S. stocks and lumber prices rose sharply, the latter of course with particularly notable price volatility, following the turbo fiscal and monetary policy injections in response to COVID, but since the start of 2022, we have seen a marked deviation between the two indices. For while U.S. stocks stumbled through October 2022, they have subsequently rebounded sharply. In stark contrast, lumber prices continued to decline into early 2023 and have only stabilized with back-and-forth price action through the year-to-date.

Putting this together, it remains to be seen and will be worth monitoring whether lumber prices ultimately catch up to their U.S. stock market implied price toward $2,000, which would be bullish for the economic and market outlook, or if U.S. stocks catch down to their lumber implied price toward 3000 on the S&P 500 Index. The latter outcome, of course, would imply the onset of an economic recession and an echo bear market.

My base case? Lumber ultimately catches up with U.S. stock prices, as the shortage of housing stock and the persistent strength of the U.S. economy provide support for lumber to eventually catch up. With that being said, higher mortgage rates and the threat of further banking instability have the potential to upend this base case scenario before it’s all said and done. This is a downside risk worth monitoring in the months ahead.

Bottom line. It is the beauty of asset allocation and considering the broad range of categories across the capital market spectrum. For while trying to determine the likely path forward for the most commonly known and followed asset classes like stocks and Treasuries, assessing their relationship with various more specialized segments can help inform what we should reasonably expect from capital markets in general going forward. And strange bedfellows like these are worth monitoring in the months ahead for the useful information that they can provide in the asset allocation decision making process.

Disclosure: Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.