It was all going so well for the doves. The U.S. stock market continued to surge to new all-time highs at the same time that bond yields were plunging, all in anticipation of the U.S. Federal Reserve cutting interest rates at their mid-September Open Market Committee meeting. But no sooner did the Fed actually deliver with a greater than originally expected half point rate cut, and U.S. Treasury yields went soaring higher. While stocks continued to advance into this headwind for several weeks, more recently they’ve taken a pause. What’s thrown a wrench into the easy money narrative of just a few weeks ago? The renewed rise of inflation concerns.

Taking a breather. Don’t get me wrong. The U.S. stock market is continuing to have a sizzling 2024. Trading north of 5800 on the S&P 500, U.S. stocks are higher by more than +20% this year. And while stocks have taken a bit of a breather in recent weeks as third quarter earnings season gets into full swing, it’s still within striking distance of fresh new all-time highs on any given trading day. Moreover, while the corporate earnings outlook for the current quarter has been revised slightly lower so far this reporting season, estimates have been revised higher by more than 2% through the remainder of 2025.

Nonetheless, the U.S. stock market continues to grapple with some mounting headwinds. These include current valuations on the headline index that are now north of 29 times earnings on an as reported basis, which is historically very expensive. In addition, corporate profit margins on the S&P 500 continue to hover near peak levels near 12% that are well above the historical average. While these factors have not constrained a further advance in stock prices to date, the renewed threat of inflation would thrust both of these metrics into the spotlight in a hurry. Put simply, inflation is poison for stock valuations (lower) and corporate profit margins (lower), both of which lead to lower stock prices all else equal.

Bond broadside. While the U.S. stock market continues to sail into these headwinds, the same cannot be said for the bond market in general and U.S. Treasuries in particular. After touching a post inflation cycle low of 3.6% right around when the U.S. Federal Reserve made their announcement on rates, Treasury yields have surged sharply higher in the weeks since, reaching as high as 4.3% in recent trading days. Such are not the yield movements of a bond market that is excited about Fed rate cuts. Instead, it is a signal that bond investors are worried that among other things the Fed may be coming in too hot and too fast with their rate cuts in what is an already brimming U.S. economy with lingering inflation pressures.

Inflation watch. So what should investors be watching in the days ahead to determine whether the recent rise in bond yields is merely a blip on the radar or the early warning signals of a renewed inflation outbreak?

First, continue to watch the 10-Year U.S. Treasury yield. Yields have been moving in a converging sideways oscillating pattern for some time now. After bottoming at the low end of this narrowing channel at 3.6% back in mid-September, it is now pressing toward the high end of this range near 4.4% today. For the more opportunistic investor, Treasuries could represent a potential buying opportunity if yields continue to surge toward this current support level. Conversely, if yields blast through the top end of this converging channel, it may signal that renewed concerns about inflation could be becoming more entrenched, which would bode ill for stock prices as well.

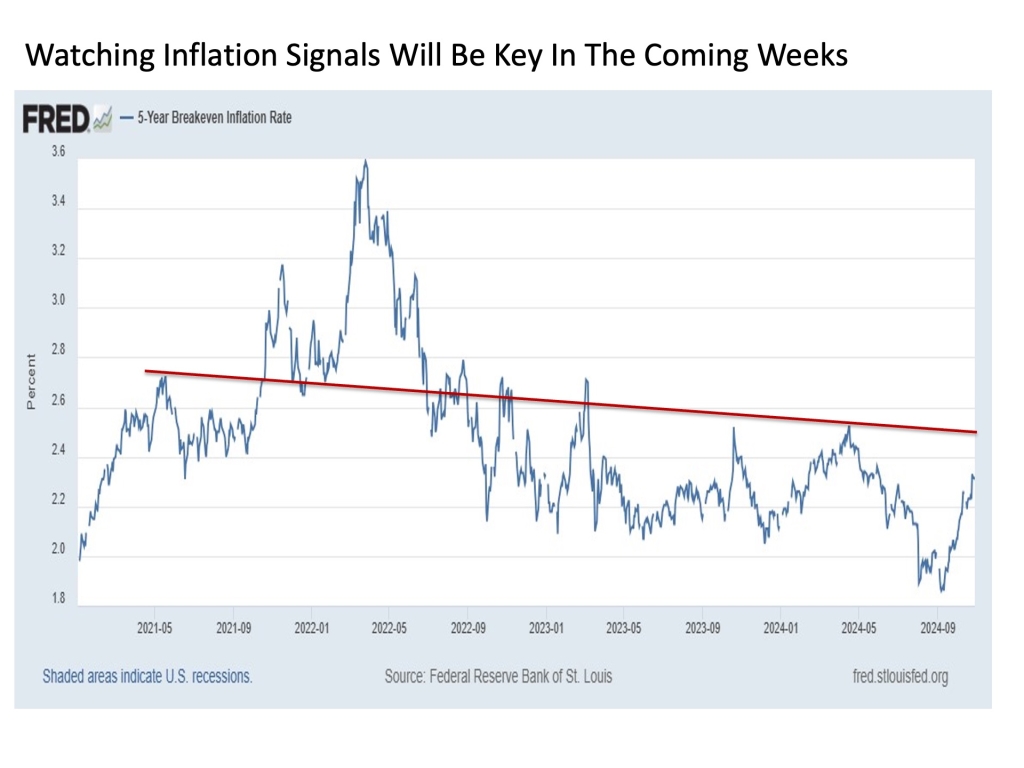

Another signal to watch is the 5-Year Breakeven Inflation Rate, which effectively measures investor expectations for average inflation over the next five years. After dipping below 2% for the first time in years leading into the recent Fed meeting in September. They have surged sharply higher toward 2.3% in recent weeks with seemingly no end in sight to the rise. Breakevens have also been trending steadily lower for years, and a reading as high as 2.5% would remain consistent with the very high end of this current downtrend range. But if we see breakevens power sustainably above 2.5%, this would suggest that the inflation problem could be bigger and stickier than thought just a month or two ago.

Bottom line. The threat of inflation remains the number one downside risk to the markets as we move through the final months of 2024. It’s not only bad for stocks, but its also bad for bonds. And despite the Fed’s eagerness to cut interest rates, pricing pressures continue to linger under the surface including services inflation still hovering near 5%. As a result, while U.S. stocks continue to press new all-time highs, it remains as important as ever to monitor the inflationary risks.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 652025-1